If you ever feel that your budget works never end, AI tools for personal finance can make them manageable. These tools simplify the budget, monitor the dates of the bills, and send the reminder in advance, and automatically send the small savings so that you can make cushions without thinking about it. You can also use AI for placing investment contributions, accurately classifying transactions, and surface spending samples that are not clear in monthly statements.

Here is a fast randown of the best personal finance AI tools.

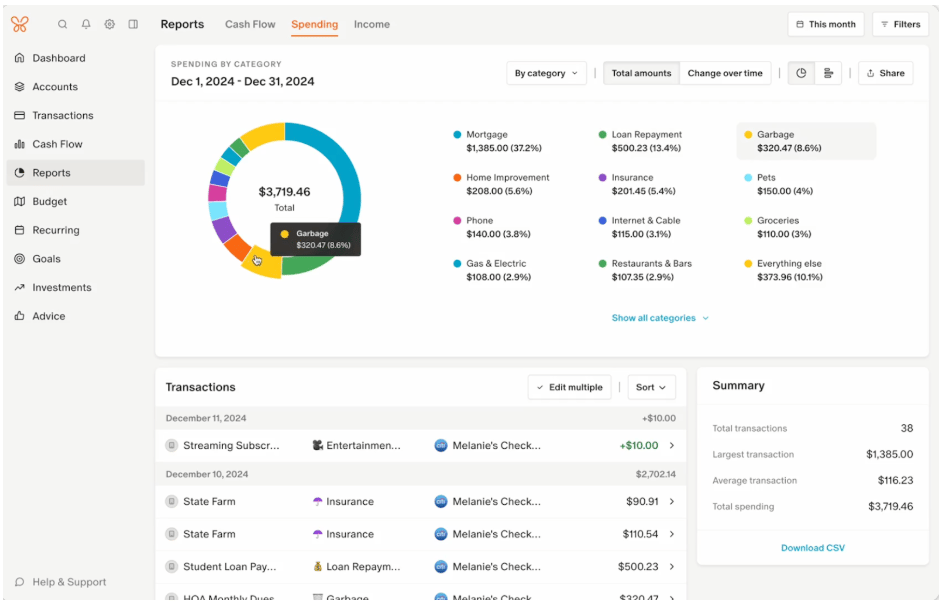

Monel’s amount: Best for active budget and domestic

Monark mini is an AI finance tool that facilitates tracking costs, budgets and planning in a platform. The king pulls into accounts, credit cards, loans and investment checks, and then uses AI to easily understand category, surface cost samples and understand.

You can set monthly hats, make round tracks, and distribute a theory with a partner to ensure the budget remain realistic. Prior to forecasting and repeated cost tracking, before you help you plan cash flows before it becomes a problem, and the customs rules keep the category clean over time.

This Personal Finance Ai Toll Monthly. Starts at 14.99 and offers a seven -day free trial.

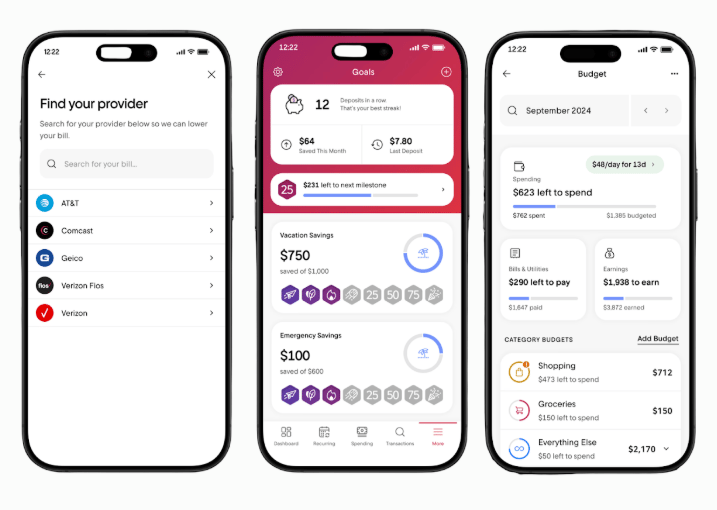

Rocket Money: Best for Subscript Clean -Up and Bill Control

Rocket Money is an AI Bringing app that offers limited limited features to help you manage your personal financial affairs without any price. It helps to cancel subscriptions, flag prices, and cancel services you don’t need. The app can discuss low rates for cable, the Internet and phone, and it offers automatic savings that transmit a small amount of vault without breaking your budget. The warnings for fixed dates and low balances maintain late fees, and the dashboard makes it clear that where the money is coming out.

If you want to make an unlimited budget, automatically make your savings, and customize your budget category, you can subscribe to the rocket money premium membership, which starts at about $ 6 a month.

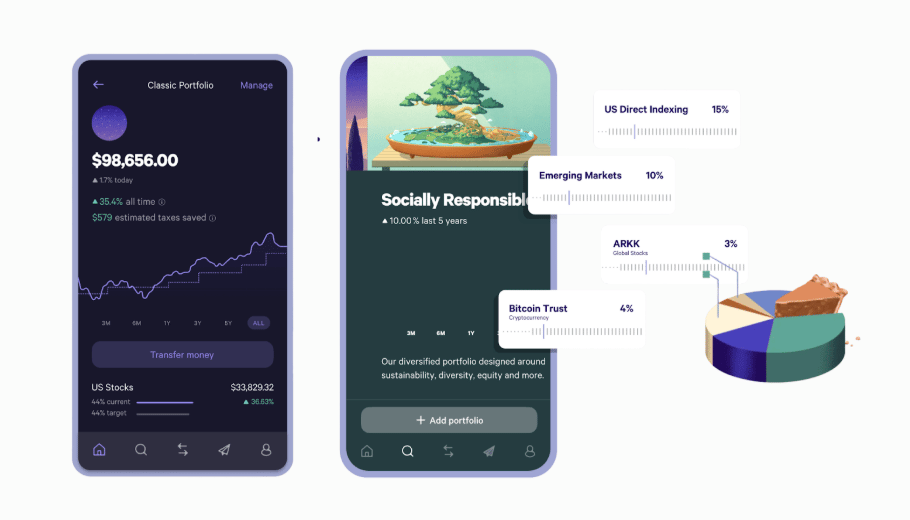

Wealth Front: Best for automated investment with cash features

When it comes to low cost, passive portfolio management, Wealth Front is one of the best personal finance AI tools. It applies diverse ETF portfolio, automatically and maintains it, and applies the harvesting of TAX tax loss to improve the post -tax results.

You can schedule the transfer of pay, track targets, and short -term cash parks in the same ecosystem for more production, keeping the funds accessible. The interface is supportive of the trading drama, which makes it easier to stick to your project through market swings.

The consulting fee starts with at least $ 500 from 0.25 % each year. The Wealth Front does not offer free trials.

Bottom line: Make your financial affairs automatically with AI

Personal Finance AI Tolls will not discuss your salary or will eliminate debt overnight, but they will keep your budget correct, transfer cash in savings on schedule, flag wasteful expenditures, and will permanently invest.

If you are new to the use of AI tools for personal finance management, start by identifying your biggest obstacle and choosing the same tool that will solve your needs. Then, connect your accounts and set up three matrix to review within 30 days, such as dollar savings, category trimming, and automatic contributions.

Sign up for free plans or trials to experience until you get the right AI tool, then make it automatic your personal financing.

Bargain buyer, check some of my favorite Free AI Tolls.

The best post for personal finance AI tools was published in First on Equivir.